In an initial public offering (IPO), often known as a stock launch, a company's shares are sold to institutional investors, as well as typically to retail (individual) investors. One or more investment banks typically underwrite an IPO and coordinate the shares' listing on one or more stock markets. A privately held firm becomes a public company by this procedure, which is also known as floating, going public, or going public. Initial public offerings can be used to increase a company's equity capital, monetize private shareholders' investments, such as those made by the company's founders or private equity investors, and make existing holdings and future capital raising easier to trade by becoming publicly traded.

Following the initial public offering (IPO), shares can be freely exchanged in the open market, or "free float." The minimum free float is set by stock exchanges both in absolute terms (the sum value calculated by multiplying the share price by the number of shares sold to the public) and as a percentage of the total share capital (i.e., the number of shares sold to the public divided by the total shares outstanding). Although an IPO has numerous advantages, there are also considerable costs involved. These costs mostly relate to the process itself, including banking and legal fees, as well as the ongoing need to provide crucial and occasionally sensitive information.

A lengthy document called a prospectus is used to provide potential buyers with information about the planned offering. The majority of businesses use an investment banking company serving as an underwriter to help them with their IPO. Among the many services that underwriters offer is assistance with accurately determining the value of shares (share price) and creating a public market for shares (initial sale). Alternative approaches, including the Dutch auction, have also been investigated and used for a number of IPOs.

What Is the Process of an Initial Public Offering?

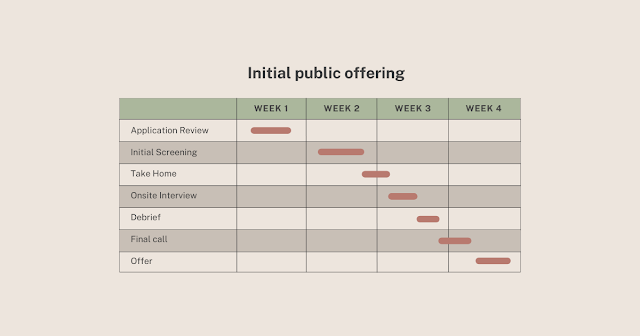

There are essentially two steps in the IPO process. The pre-marketing stage of the offering is the first, and the actual initial public offering is the second. A company that wants to go public will either request private bids from underwriters or make a public announcement to pique interest. The corporation selects the underwriters, who oversee the IPO process. A business may select one or more underwriters to oversee certain phases of the IPO process jointly. Every step of the IPO process, including due diligence, document preparation, filing, marketing, and issuance, is handled by the underwriters.

Why Do an Initial Public Offering?

Although an initial public offering (IPO) may be the first opportunity for the general public to purchase shares of a company, it's crucial to realize that one of the IPO's goals is to enable early investors in the company to withdraw their capital.

Think of an initial public offering (IPO) as the conclusion of one stage in a company's life cycle and the commencement of another because many initial investors desire to sell their shares in a start-up or new business. As an alternative, shareholders in more mature private companies planning to go public may also seek the chance to sell some or all of their shares.

According to Matt Chancey, a certified financial planner (CFP) in Tampa, Florida, "the reality is that there are friends and family around, and there are some angel investors that got in first." A lot of private capital, similar to that from Shark Tank, is invested in businesses before they eventually go public.

Other factors for pursuing an IPO include cash raising or increasing a company's visibility in the public:

Shares can be sold to the general public to help businesses raise more money. The money raised could be put to good use by financing business growth, R&D, or debt repayment.

It can be too expensive to use other methods of fundraising, such as bank loans, venture capitalists, and private investors.

Companies can receive a ton of publicity by going public through an IPO.

Companies may desire the prestige and stature that come with becoming publicly traded companies, which may also enable them to negotiate better loan terms.

Going public may make it simpler or less expensive for a business to raise funds, but it also complicates a lot of other issues. It is necessary to disclose information, for example, by publishing quarterly and annual financial reports. In addition to having to record actions like top executives trading stocks or exploring acquisitions, they also have to answer to the shareholders.

How Does an Initial Public Offering Work?

Most businesses find it tough to handle the lengthy, laborious process of going public on their own. In addition to preparing for an exponential rise in public scrutiny, a private firm seeking an IPO must also submit a massive amount of paperwork and financial disclosures in order to comply with the Securities and Exchange Commission's (SEC) rules governing public corporations.

Because of this, a private company that intends to go public employs an underwriter—typically an investment bank—to provide advice on the IPO and aid in the determination of the offering's starting price. A roadshow is a meeting with potential investors that is scheduled by underwriters to help management get ready for an IPO.

To assure extensive distribution of the new IPO shares, the underwriter assembles a syndicate of investment banking companies, according to Robert R. Johnson, Ph.D., a chartered financial analyst (CFA) and professor of finance at the Heider College of Business at Creighton University.

A portion of the shares will be distributed by each investment banking firm in the syndicate. The underwriter issues share to investors once the firm and its advisors have decided on an initial price for the IPO, and the company's stock then starts trading on a public stock market like the New York Stock Exchange (NYSE) or the Nasdaq.

Initial Public Offering History

Although not all contemporary scholars agree with this assertion, the publicani were the first type of firm to issue public shares under the Roman Republic. The publicans were legal entities separate from their members, whose ownership was divided into shares, or parties, much like contemporary joint-stock businesses. In the Forum, close to the Temple of Castor and Pollux, there is evidence that these shares were offered to the general public and exchanged there. The shares' value fluctuations encouraged speculators, or quaestors, to engage in activities.

There is little data left to describe the stock market's behavior, the form of initial public offerings, or the prices for which parts were sold. With the demise of the Republic and the establishment of the Empire, Publicani fell out of favor. The Bank of North America's public offering in about 1783 was the first IPO in the United States.

IPO Advantages and Disadvantages

Advantages

One of the main benefits is that the company can raise money by accepting investments from the entire investing public. This makes acquisition deals (share conversions) simpler to complete and improves the company's visibility, reputation, and public image, all of which can boost sales and profitability. A firm can typically benefit from more favorable credit borrowing conditions than a private company thanks to the increased transparency that comes with compulsory quarterly reporting.

Disadvantages

Companies may encounter a number of drawbacks to going public and may decide to adopt alternative tactics. One of the biggest drawbacks is the high cost of initial public offerings (IPOs), as well as the continuous and frequently unrelated costs of sustaining a public company.

For management, which may be paid and assessed largely on stock performance rather than actual financial results, fluctuations in a company's share price can be a distraction. The business must additionally publish financially, accounting, tax, and other business data. It might be forced to publicly divulge trade secrets and business strategies during these disclosures, which could give rivals an advantage.

It may be more challenging to keep competent managers who are prepared to take chances if the board of directors has rigid leadership and governance. There is always the option to keep things secret. Companies may also request bids for a takeover rather than going public. In addition, businesses could look into several alternatives.

Alternatives to The IPO

Listing Directly

When there are no underwriters involved, the IPO is referred to as a direct listing. Direct listings omit the underwriting step, putting the issuer at greater risk if the offering fails, but they also may result in higher share prices for the issuer. A direct offering is typically only possible for a business with a strong brand and a lucrative industry.

An Auction in Dutch

A Dutch auction does not establish an IPO price. Shares can be bid on by interested buyers, along with their desired price. The available shares are subsequently distributed to the bidders who offered the highest price.

Investing in An Initial Public Offering

Only when extensive evaluation and analysis are complete can a firm decide that raising cash through an IPO will optimize the profits for early investors and raise the most money for the business. The likelihood of future growth is therefore strong, and many public investors will be in line to purchase shares for the first time when the IPO decision is made. When an initial public offering (IPO) attracts a large number of buyers from the primary issuance, it becomes even more desirable because IPOs are sometimes discounted to ensure sales.

Initially, the underwriters typically determine the IPO's pricing through their pre-marketing procedure. Fundamental methodologies are used to value the company as the basis for the IPO price. Discounted cash flow, which is the net present value of the company's anticipated future cash flows, is the most widely utilized technique. On a per-share basis, underwriters and potential investors examine its worth. In addition to these, equity value, enterprise value, comparable firm adjustments, and more may be utilized to determine the price. Demand is taken into account by the underwriters, although they also frequently lower the price to boost sales on the IPO day.

Analyzing the technical and fundamentals of an IPO issuance can be challenging. Investors will read the headlines, but the prospectus, which is available as soon as the firm files its S-1 Registration, should be the primary source of information. 3 There is a ton of helpful information in the prospectus. Investors should pay close attention to the management team's comments, the underwriters' qualifications, and the deal's specifications. Big investment banks that can effectively market a new issue will often support successful IPOs.

In general, the path to an IPO is fairly drawn-out. As a result, as interest grows, public investors can keep up with breaking news and other facts to support their estimation of the ideal and prospective offering price. Demand from major private accredited investors and institutional investors, who have a significant impact on the IPO's trading on its first day, is often included in the pre-marketing process.

Public investors don't participate until the final offering day. All investors are eligible to participate, but only those with trading access are allowed to do so. Having an account with a brokerage platform that has received an allocation and wants to distribute it with its clients is the most typical route for an individual investor to obtain shares.

Initial Public Offering Pricing

A firm preparing for an IPO will normally hire a lead manager, often referred to as a bookrunner, to assist in determining the right price at which the shares should be issued. The price of an IPO can be established primarily in two ways. Either the corporation establishes a price with the assistance of its lead management (the "fixed price approach"), or the price might be established by analyzing private investor demand data gathered by the bookrunner ("book building").

In the past, many IPOs were overpriced. Underpricing an IPO has the effect of increasing interest in the stock when it first starts trading publicly. For investors that received shares of the IPO at the offering price, flipping, or swiftly selling shares for a profit, can result in huge returns. Underpricing an IPO, however, costs the issuer potential capital.

Theglobe.com's IPO, which contributed to the IPO "mania" of the late 1990s internet era, is one extreme example. The IPO was priced at $9 per share on November 13, 1998, and it was underwritten by Bear Stearns. On the first day of trade, the share price swiftly rose 1,000% to a high of $97. The stock ultimately fell back down due to institutional flipping's selling pressure, closing the day at $63.

The amount of demand for the offering and the volume of trading that occurred are thought to have cost the business upwards of $200 million, despite the fact that they did raise roughly $30 million through the sale.

Another crucial factor is the risk of overcharging. It may be difficult for the underwriters to fulfill their obligations to sell shares if a stock is offered to the public at a price higher than the market would bear. The stock price could decrease on the first day of trade even if they sell every share that was issued.

If so, the stock might lose its ability to be sold, which would reduce its value even further. Investor losses may arise from this, despite the fact that many of them are the underwriters' most valued customers. Perhaps the most well-known instance of this is the 2012 IPO of Facebook.

As a result, while setting the price for an IPO, underwriters analyze a wide range of factors and work to determine an offering price that is both high enough to generate sufficient funding for the firm and cheap enough to generate interest in the stock. Underwriters employ a range of non-GAAP measurements and key performance indicators when determining the price of an IPO. [19] The underwriters ("syndicate") typically arrange share purchase agreements from top institutional investors as part of the process of selecting an ideal price.

Final Word

An IPO stands for Initial Public Offering. It is a process where the company decides to sell its shares in the market and raise funds. The first time an IPO happens is known as “unicorn’s hour,” because such companies are so rare that it can be hard to find any others with a similar track record at the same time.

To help you catch up, we have also prepared an infographic breaking down some of the biggest public offerings – including Alibaba, Facebook, Snapdeal, and more – during this period. Enjoy.

More: Relaxation Day, Cyber Monday, Mexican Independence, Sweetest Day

Post a Comment